Reports out of Russia on Monday indicated that there was a rush among some consumers to trade their rubles for other currencies, in order to protect savings from sudden devaluation. The Russian central bank's foreign currency reserves could have allowed it to take some of the pressure off the ruble by using those funds to purchase rubles on the open market.

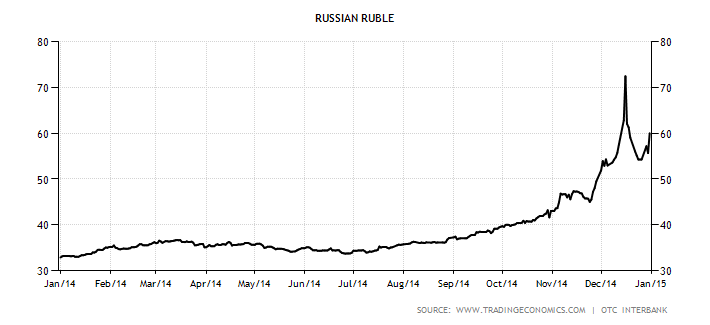

On Monday, as people and companies rushed to exchange their rubles for dollars, the price of one dollar rose to nearly 118 rubles. For example, last week, it was possible to buy one U.S. When markets lose confidence in the value of a currency, it costs more to exchange that currency for other currencies on the open market. The impact of the Russia freeze was immediately apparent Monday. President Jimmy Carter after Islamic revolutionaries in that country unseated Mohammad Reza Shah Pahlavi and took American embassy personnel hostage. "The only precedent I'm aware of is Iran, which had, of course, a much different level of integration with financial markets than Russia does," he told VOA. Milesi-Ferretti said that the decision to freeze funds belonging to Russia's central bank is practically unprecedented when it comes to a major economy. "Fundamentally, the fact that the central bank has that foreign currency allows the central bank to intervene in a way that prevents a disorderly depreciation of the currency," Gian Maria Milesi-Ferretti, a senior fellow at the Brookings Institution's Hutchins Center on Fiscal and Monetary Policy, told VOA. One of the main reasons central banks hold foreign currency reserves is to allow them to protect their own currencies from sudden price changes. Run by the Society for Worldwide Interbank Financial Telecommunication, the SWIFT network is essential to the smooth operation of the global banking system.Īmong other things, the sanctions announced Monday block the Russian Central Bank's access to large portions of its $630 billion in foreign currency reserves. Those actions came on top of an international agreement to cut off some Russian banks from the SWIFT network, which banks use to facilitate international transactions. "Today, in coordination with partners and allies, we are following through on key commitments to restrict Russia's access to these valuable resources."Īt the same time, governments around the world, including the member states of the European Union, the United Kingdom, Japan, Singapore, Australia and others announced similar restrictions. "The unprecedented action we are taking today will significantly limit Russia's ability to use assets to finance its destabilizing activities, and target the funds Putin and his inner circle depend on to enable his invasion of Ukraine," Secretary of the Treasury Janet L.

That includes banks that hold assets belonging to any of those entities. companies from doing business with the Central Bank of the Russian Federation, the National Wealth Fund of the Russian Federation, and the Ministry of Finance of the Russian Federation. Treasury officially announced that it had barred U.S. The United States and other Western countries took extraordinary steps to cut Russia off from the global financial system over its invasion of Ukraine, blocking its ability to prevent a major devaluation of the ruble on foreign exchange markets, and severely limiting the ability of its banks to make international transactions.

0 kommentar(er)

0 kommentar(er)